The SaaS market is exploding. Currently, it’s worthwhile billions of dollars flowing through various revenue channels: subscription fees, investors’ contributions, etc. In this high-pressure environment, growth isn’t just alluring. It’s essential for a business’s survival.

You should understand your customers to ensure that you win a marketing race. Examine your business with essential metrics in digital marketing. That way, you can determine your product’s strong and weak points and optimize your email email marketing strategy.

Today, we will share the 6 most vital customer success metrics for SaaS business. Read this article to implement new indicators into your customer success strategy and achieve business growth.

The Importance Of Customer Success Metrics

Customer success metrics are crucial for any business. By thoroughly studying them, you’ll better understand which marketing approach works best in your case.

You can personalize marketing messages, achieving higher conversions. Clients will stay longer with you and are more likely to recommend your product. In the long run, it will lead to higher customer lifetime value (CLV) and reduced churn.

Key SaaS metrics can also provide a common ground for different teams (product, marketing, sales, support) to understand customer needs and challenges. It will create a culture of accountability inside the company, as each employee will see the impact of their actions.

7 Vital KPI Metrics for SaaS Businesses

There are dozens of KPIs for SaaS companies: some are relevant only to enterprise businesses, while others suit small businesses. However, the 7 essential metrics in digital marketing we cover in this article will fit businesses of any size.

We’ve gathered all of them in one place to ease you through the research process. You can calculate them in marketing toolkits or use the following formulas to estimate them on your own.

Cost Per Acquisition (CPA, CAC): Figure Out The True Price Of the Customer

By using this metric, you can gauge the price of bringing in more high-intent leads — your potential customers. Once you know your CPA for different marketing approaches, you can determine which benefits you more. Knowing your customer acquisition cost lets you set realistic budgets and fine-tune your approach.

It’s easy to calculate the CPA formula since it looks like this:

CPA = Total Customer Acquisition Costs / Number of New Customers Acquired

Imagine you spent $10,000 on marketing and sales in a month and acquired 20 new customers. Your customer acquisition cost would be the next:

CPA = $10,000 / 20 customers = $500 per customer

Contrary to popular myths, you don’t need to spend all your effort trying to lower the CPA. We recommend you look for a balance between cost per acquisition and customer quality.

Customer Lifetime Value (CLV): Find Out Client’s Payoff

With this metric, you can estimate the revenue from the average customer throughout their entire relationship with your business. CLV helps you understand the monetary value of your clients beyond just single transactions. B2B revenue recognition process can help to get real CLV data for your business so you need to follow the rules and regulation while recording the revenue.

Analyzing customer lifetime value across different customer segments can reveal which features drive the most value, guiding your product development roadmap.

There are different formulas for calculating CLV, depending on the project’s complexity. In this article, we will share with you a basic formula:

CLV = Average Customer Value * Average Customer Lifespan

While calculating the value, consider all revenue that the client provides you. Combine subscription fees, one-time purchases, upsells, etc. While evaluating the lifespan, pick the average duration a client stays with your service. Look at historical data like churn rates or subscription lengths.

Example: Imagine a customer pays $10 monthly and stays subscribed for 2 years (24 months). Their CLV would be the following:

CLV = $10/month * 24 months = $240

It means you can expect to generate $240 from this customer over their lifetime.

Daily Active Users (DAU): Determine Your Potential To Grow

It is one of the key SaaS metrics for user engagement in mobile apps and web platforms. It shows how many users interact with your service daily.

The definition of “active users” can vary depending on your product and goals. We recommend you set as “active” any easy and repetitive action: logging in, completing a task, or spending a certain amount on the service.

Analyze DAU trends across user demographics or regions to better understand engagement patterns and tailor your product or marketing accordingly. Use it in tandem with other metrics for a more complete picture.

Net Promoter Score (NPS): Figure Out The Satisfaction

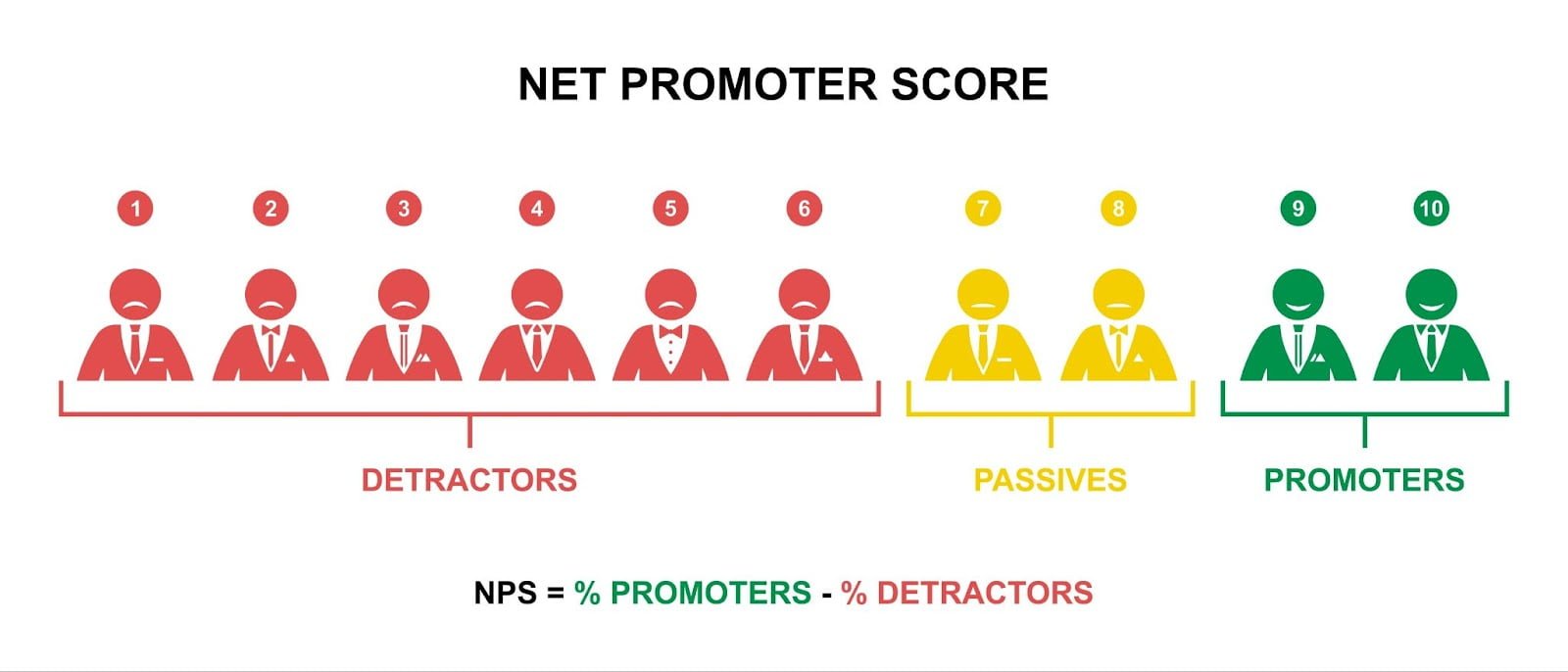

With NPS, you can evaluate overall customer satisfaction and determine areas for improvement. NPS score is based on a single question about user experience: “On a scale of 0-10, how likely are you to recommend our product?”. You can categorize responders into three groups:

- Promoters (9-10): Loyal customers who will likely recommend you.

- Passives (7-8): Neutral customers.

- Detractors (0-6): Unhappy customers who may recommend others don’t use your service.

The net promoter score is derived by subtracting the percentage of detractors from the percentage of promoters.

If you have 30% Promoters, 50% Passives, and 20% Detractors, your net promoter score calculation is next:

NPS = 30% (Promoters) – 20% (Detractors) = 10

Customer Satisfaction Score (CSAT): Determine Points To Upgrade

With this metric, you can determine whether clients like the specific interaction with your business. While NPS measures brand loyalty, CSAT focuses on satisfaction with a certain touchpoint. It can be a recent purchase, support interaction, or product update.

CSAT provides immediate user engagement feedback on specific interactions. That way, you can quickly identify areas of delight and frustration. You definitely saw the CSAT form on many digital products. It’s a simple survey, often with a scale of 1-5 or smiley faces, asking users how satisfied they are with the recent experience. Collect customer feedback to get genuine feedback about the product.

Return on Investment (ROI): Achieve Your Full Earning Power

Some people take investments as a guessing game where they put money into some decision just because they like it. In those cases, it’s nearly impossible to determine whether some action is profitable for business. Some may like it, while most investors still ask you to show the potential profit of your future actions. We highly recommend you stick with numbers, which will show you the true value of your efforts.

Don’t worry about deadlines since you don’t spend much time on estimations. Usually, you spend less than an hour even with the complex calculations. However, it can save months and thousands of dollars on the development.

ROI tells you how much you get in return, expressed as a percentage. With this metric, you can tell which action will have the highest potential return. It also helps you to make data-driven conclusions and attract investors. Here is the formula for calculating ROI:

ROI = (Profit – Expenditure) / Expenditure * 100%

Suppose you invest 10 thousand in developing a new tool and achieve 20 thousand in revenue. We can congratulate you since you get all your money back:

ROI = (20,000 – 10,000) / 1,000 * 100% = 100%

Whether it is a good or bad indicator depends on the decision and current industry trends. Remember also to track impalpable aspects like brand awareness and employee satisfaction. Such efforts resulting in lower ROI may seem less important, but they can open up more revenue opportunities in the long run.

Revenue Growth: Set Materialistic Aims

By using it, you can tell how your earnings change over time. It helps you to figure out your inner income trends and what actions benefit you most. While some can see them as ROI twins, that’s not exactly the case.

ROI focuses on the efficiency and profitability of an investment, while revenue growth examines an increase in your total revenue over a specific period. They are both vital financial metrics that you should use in your campaigns.

This parameter can show how your earnings change over time in percentage rate. While numbers can trick our minds, telling us that you don’t earn as much as you want, percentages show a real ratio between 2 revenues.

Revenue growth reveals whether your business is moving in the right direction. If you prosper, investors and stakeholders will see it as proof of your words. Here is how you can estimate your income growth:

Revenue Growth = ((Current Period Revenue – Previous Period Revenue) / Previous Period Revenue) * 100%

If your gain was $10,000 this month and $8,000 last month, your growth would be:

Revenue Growth = ((10,000 – 8,000) / 8,000) * 100% = 25%

As we tell you, 2 thousand-dollar income growth may not look as big as you thought. But once you convert it into a ratio, you understand that your income grew by 25%.

A clear understanding of your income growth rate helps you set realistic, achievable goals. You also get more chances to attract and retain top talent interested in working with a growing company.

Strategies for Improved KPI Tracking in Your Business

The seven crucial metrics for SaaS businesses are like using GPS in the digital landscape. They guide you toward achievable goals and help adapt strategies based on user engagement.

By harnessing the power of these metrics, businesses can pave the way for enhanced customer experiences, increased profitability, and a brighter future in the competitive landscape of the SaaS market.

About Post Author

Victoria Berezhetska

Victoria Berezhetska is a Content Lead at Phonexa. She covers diverse topics around digital marketing, including affiliate marketing, call tracking, and more.

![8 Email Marketing Audit Steps You Must Know [2024 Ultimate Guide]](https://www.growmeorganic.com/wp-content/uploads/2024/07/GMO-covers-updated-49-300x169.png)